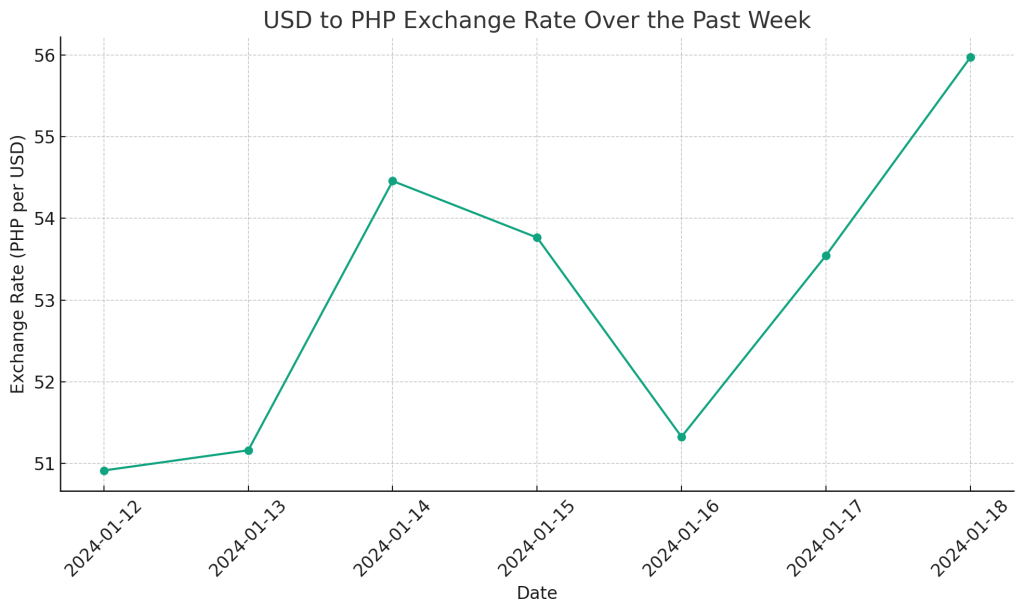

The USD to PHP (United States Dollar to Philippine Peso) exchange rate remains an important financial indicator for investors and individuals involved in cross-border transactions. This past week has seen notable fluctuations in this rate, as depicted in the graph below.

Starting from January 12, 2024, the exchange rate exhibited variability within the range of 50 to 55 PHP per USD, as per the example data. Such fluctuations can be influenced by various factors including geopolitical events, economic data from the United States and the Philippines, and global market dynamics.

Interestingly, the latest information from the Bankers Association of the Philippines (BAP) as of January 19, 2024, indicates a significant exchange rate of 55.85 PHP per USD at opening, peaking at 56.02 PHP per USD, and closing at 55.97 PHP per USD. The average exchange rate for the day was approximately 55.874 PHP per USD. These figures reflect the outcomes of interbank trading and provide a benchmark for daily USD to PHP conversions.

The week began with the exchange rate on the lower end, potentially due to positive economic outlooks in the Philippines or reactions to US economic policies. The midweek rise could be attributed to shifts in market sentiment or new economic information. Such spikes often reflect heightened demand for the USD or concerns about the Philippine economy’s stability.

As the week progressed, the rate showed signs of stabilization, important for businesses engaged in import-export activities between the two countries. This provides a more predictable environment for pricing and cost planning.

The USD to PHP rate is influenced by the monetary policies of the US Federal Reserve and the Bangko Sentral ng Pilipinas (BSP), the central bank of the Philippines. Interest rate decisions, inflation rates, and economic growth projections from these institutions are closely monitored.

External factors such as global commodity prices, trade policies, and geopolitical tensions also play a significant role. Changes in US-China trade relations, for instance, can indirectly impact the USD to PHP rate.

For Filipinos, a stronger dollar can mean higher costs for imports and potential inflationary pressures. Conversely, a weaker dollar can enhance the competitiveness of Filipino exports but might also indicate concerns about the US economy.

Concluding, the past week’s trends in the USD to PHP exchange rate, including the latest BAP data, highlight the dynamic nature of forex markets and the interconnectedness of global economies. Staying updated with economic news and analyses remains crucial for understanding these exchange rate movements and their implications.